For business decisions, mass vaccination, which highlighted the country among few around the world, and renewed global optimism are not enough to offset the growing perception of local sociopolitical risks, now exacerbated by the results of the recent elections. Decision-makers continue to face the challenge of leading their companies through what some have called the “new normal” with considerable uncertainty.

In this context, it is worth asking how companies can emerge successfully. To this end, we published an analysis in January of the open companies in Chile to identify those that had generated the most value during the crisis and to understand the common decisions and actions of these successful companies as a source of inspiration for all, to navigate the crisis and prepare to thrive in the post-crisis recovery. We measured the return of their stock between September 2019 and the last day of 2020, and the results are detailed in our article “VALUE CREATION IN COMPANIES IN CHILE DURING THE COVID-19 CRISIS.”

Furthermore, studies and articles from Harvard Business Review and global consulting firms over the last 10 years indicate that companies that navigate crises well also perform better in the following years. For this reason, we decided to repeat our analysis, including the first 4 months of 2021, to verify how this thesis applies in Chile.

Analysis of Listed Companies

We analyzed the value creation (or destruction) of the major Chilean companies listed on the stock exchange from before the crises began in Chile, i.e., from September 2019, until May 13, 2021, i.e., before the elections, considering their stock prices, including dividends and capital changes. Relative to December 2020, stock values generally recovered slightly, and the IGPA and IPSA results for the period are approximately consistent, improving from -13% in December to -7% in May.

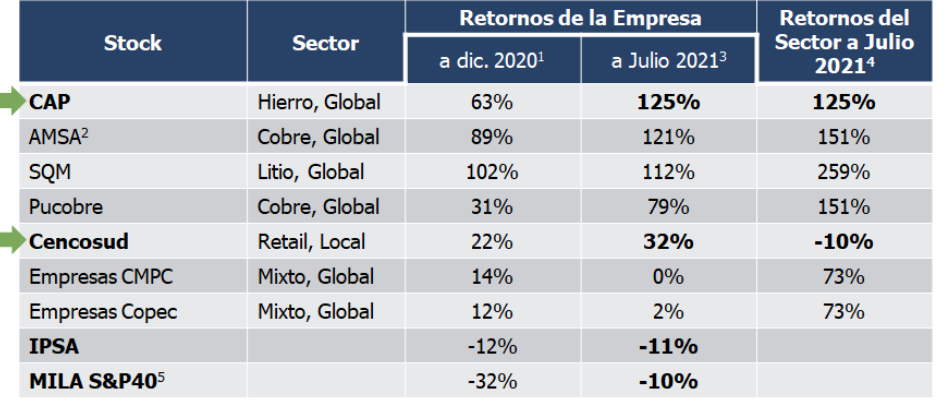

Of the 9 companies with the highest returns from the initial analysis, 7 continue to maintain returns above the local market, with AMSA, CAP, and Cencosud standing out with returns significantly higher than both the local market and their sector. While Camanchaca slightly surpasses its sector, SQM, CMPC, and Copec outperform the local market but not their global sector. From the original list, Colbún and Watt’s fall below the IPSA by May.

Stock Price Evolution of Chilean Companies

September 2019 to May 2021

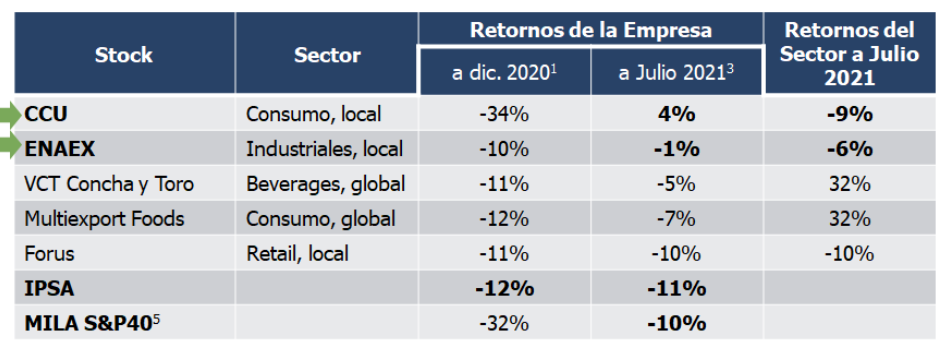

Additionally, two local operational companies improved their stock performance in the first quarter and thus entered the list of those surpassing both the local market and their sector: Pucobre and Enaex, where Pucobre shows returns significantly higher both locally and relative to its global sector.

Nota: (1) 02/09/2019 a 30/12/2020, excluye holdings sin operaciones; (2) Cotizada en bolsa de Londres, con operaciones

principalmente en Chile, precios en CLP; (3) 02/09/2019 a 30/07/2021, excluye holdings sin operaciones, por lo mismo

excluye CSAV; (4) Sectores internacionales: VCT y Multiexport: Food and Beverage ET

For the companies that exceed the local index and also their sector at the local or global level as applicable, namely AMSA, CAP, Cencosud, Pucobre, and ENAEX, we confirmed four common characteristics that could be relevant to consider when preparing your company for a future of recovery and uncertainty, and to explore how to potentially assume a leadership position in emerging from the crisis. We detail two actions in this regard, from the companies on the list:

- Agility in Decision-Making to Face the Crisis – Pucobre achieved record production levels in 2020 and continues to make progress on new projects such as El Espino.

- Progress on the Automation and Digitalization Program, and Overall Efficiency – Enaex maintained its investments and digitalization projects during the pandemic with Enaex Bright, incorporating robotics and artificial intelligence.

- Balance Strength – All companies on the list maintain solid balances. For example, Pucobre and ENAEX have current ratios above 1.2 and debt-to-equity ratios below 1.

- Activity in Alliances or M&A During the Crisis – For example, ENAEX completed the acquisition of Downer Blasting in March, consolidating its entry into Australia and nearby markets. This move is expected to help the company exceed $1 billion in sales this year.

Final Considerations

In line with the conclusions from our initial analysis, the challenge for leadership in companies now seems to evolve from maintaining employee safety and financial and operational continuity to shaping and launching competitive actions that enable them to emerge from the crisis as winners, even as the environment shifts from health uncertainty to socio-political uncertainty. As before, companies that continue with innovation, investments, and productivity improvement initiatives will have a greater chance of success.

Ultimately, we maintain that 2021 should be a year of investment and transformation for companies seeking to capture competitive leadership and value for the decade ahead.

Publication prepared by Patrick Meynial, Partner