Despite the paradoxical nature of this publication’s title, prolonged periods without recessions can indeed create problems. One of the most intriguing and concerning issues in various countries is the proliferation and persistence of so-called “zombie companies.”

What Are Zombie Companies? Although there is no formal definition, the most commonly accepted definition is “those companies that barely generate enough cash to pay the interest on their debt, but not to repay the principal” (1). These are typically publicly traded, medium-to-large-sized companies that rely heavily on banks and their financing, which is often expensive (high interest rates).

The first examples of zombie companies date back to Japan in the 1990s, when many companies deemed “too big to fail” were rescued by the state through loans, despite poor economic performance. Several economists argue that it would have been better for the economy if these companies had gone bankrupt, which would have allowed for a more efficient reallocation of resources. Historically, local and global recessions have played this role in economies—acting as a “cleanup and purge” of companies that do not create sufficient value.

Zombie companies exist when low interest rates allow them to continue receiving financing despite their inability to create value.

How to Identify a Zombie Company?

In 2021, a study commissioned by the Federal Reserve of the United States to Favara, Minoiu, and Perez-Orive (2) to identify and measure zombie companies established the following criteria:

- Debt Level: Above the median annual debt level for the industry

- Interest Coverage Ratio: Less than 1 (EBIT/Financial Expenses < 1)

- Negative Real Sales Growth: Negative sales growth in the past 3 years (sales adjusted for inflation)

The Effect of a Crisis That Doesn’t Arrive

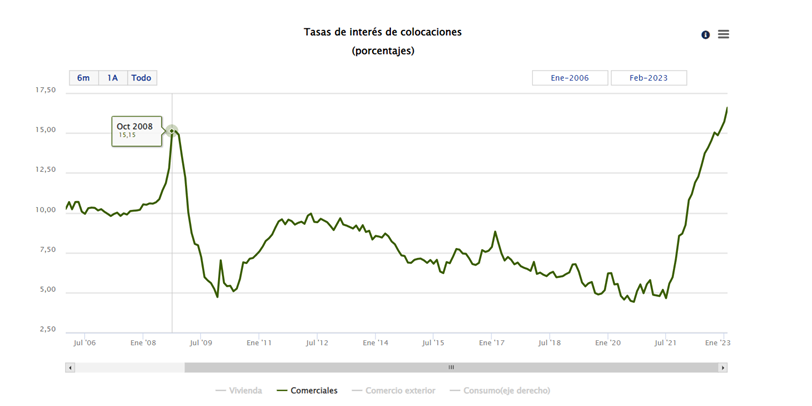

At the beginning of 2023, the consensus both locally and internationally was that the world would enter an economic recession due to the widespread increase in interest rates in various economies to curb inflation. In Chile, the increase in financing rates for companies exceeds the peak during the Subprime crisis in 2008 and is nearly three times the average cost of debt for the 2018-2021 period (3):

However, despite this, we see a shift in Chile, where local and international authorities (7 out of 10 market agents) estimated in March that the Chilean economy would grow or remain unchanged, compared to 2 out of 10 in February (4).

What Does This Mean for Our Economy?

In the short term, this reallocation of resources in the economy will continue to be postponed if these zombie companies can keep servicing their debt and obtaining financing (or entering an endless cycle of renewing their bonds and loans, which is a reality for many companies today). Lenders understand the risk but are able to offer attractive rates, seemingly supported by the companies’ solid balance sheets.

The increased risk in the system from the potential collapse of zombie companies is a concern and has prompted actions by various central banks worldwide. For example, the United States (5) and Spain (6) have developed efforts to monitor these companies and their potential impact on the economy. Their conclusions are that, generally, the impact of zombie companies is limited in their economies: these companies are found in a few sectors (e.g., manufacturing), have decreasing access to credit naturally, and eventually go through default and correction; ultimately, they conclude that zombie companies do not disproportionately benefit from lower financing rates at the expense of healthy companies.

For Chile, with a banking sector that has shown great resilience during periods of crisis and recession since the lessons of 1982, we anticipate that zombie companies are few, and the banking sector serves as a strong natural regulator of this inherent risk in the system.

Based on the above, you can continue to enjoy your favorite zombie series or movies in Chile with less concern about facing these economic realities locally.

Links and References:

- Zombies: Financial Term for Distressed Companies (investopedia.com)

- S. Zombie Firms With The Highest Potential Credit Risks | Seeking Alpha)

- Inflation and recession: Can the world defeat both in 2023? | Business and Economy | Al Jazeera

- More Analysts See Chile Escaping Recession This Year, Though Consensus Still Points to a GDP Decline (Diario Financiero)

- The Fed – U.S. Zombie Firms: How Many and How Consequential? (Federal Reserve)